CMG Stock Performance and Fundamentals

Chipotle Mexican Grill (CMG) has been a popular stock among investors for its strong growth potential and focus on fresh, high-quality ingredients. The company’s stock performance has been impressive, with significant gains over the years. However, it has also experienced some volatility, reflecting the cyclical nature of the restaurant industry and the company’s own challenges.

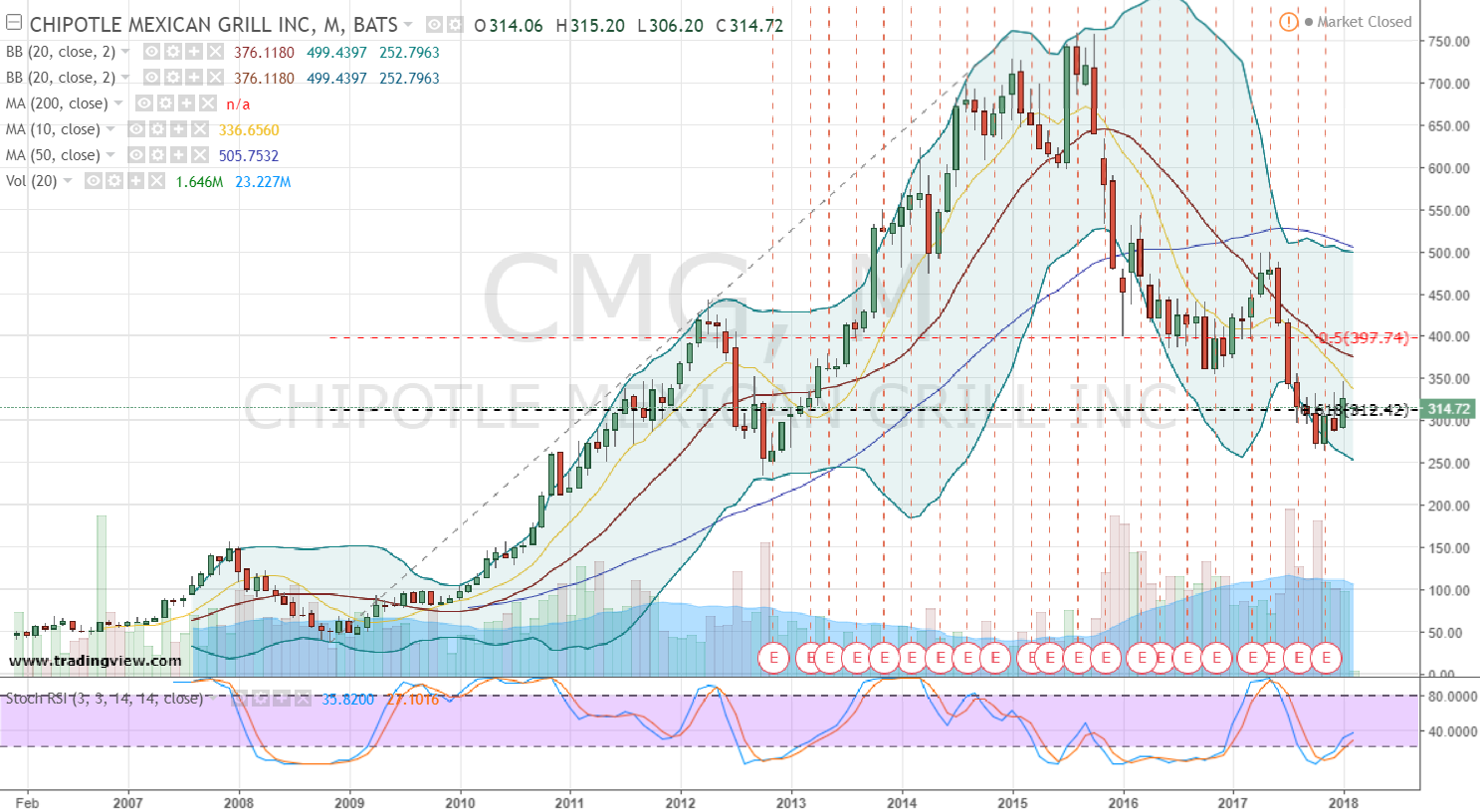

Historical Performance

CMG’s stock has delivered significant returns to investors over the long term. Since its initial public offering (IPO) in 2006, the stock has experienced significant growth, with its price increasing from around $22 per share to over $1,800 per share at its peak in 2021. This represents a remarkable return on investment for early investors.

However, the stock has also experienced periods of volatility, especially during economic downturns or when the company faced challenges, such as food safety outbreaks. For example, in 2015, the stock price dropped significantly following several food safety incidents.

Financial Metrics

Chipotle’s financial performance has been strong, with consistent revenue growth and increasing profitability.

* Revenue: Chipotle’s revenue has grown steadily over the past decade, driven by new store openings and increased customer traffic. In 2022, the company reported total revenue of over $8 billion, a significant increase from $2.7 billion in 2012.

* Earnings per Share (EPS): Chipotle’s earnings per share have also grown significantly over the years, reflecting the company’s profitability and efficient operations. In 2022, the company reported EPS of over $26, a substantial increase from $4.44 in 2012.

* Profit Margins: Chipotle has consistently maintained high profit margins, demonstrating its ability to effectively manage costs and generate profits. In 2022, the company’s operating margin was over 17%, indicating strong profitability.

Business Model

Chipotle’s business model is based on offering high-quality, customizable Mexican food in a fast-casual setting. The company focuses on fresh ingredients, sustainable sourcing, and a limited menu, which allows it to maintain consistency and efficiency.

Strengths:

* Strong brand recognition: Chipotle has built a strong brand reputation for its fresh ingredients and customizable menu.

* Loyal customer base: The company has a loyal customer base that appreciates its commitment to quality and sustainability.

* Efficient operations: Chipotle’s streamlined operations and limited menu allow it to operate efficiently and maintain consistent quality.

* Growth potential: The company has significant growth potential through new store openings and expansion into new markets.

Weaknesses:

* High labor costs: Chipotle’s focus on fresh ingredients and hand-prepared food results in high labor costs.

* Limited menu: While the limited menu allows for consistency and efficiency, it can also limit customer appeal and prevent the company from capturing a broader market share.

* Food safety concerns: Chipotle has faced several food safety incidents in the past, which have negatively impacted its reputation and stock price.

Opportunities:

* Expansion into new markets: Chipotle has the potential to expand into new markets, both domestically and internationally.

* Digital ordering and delivery: The company can leverage digital ordering and delivery platforms to increase convenience and reach a wider customer base.

* Innovation and menu expansion: Chipotle can explore new menu items and innovations to attract new customers and enhance its offerings.

Threats:

* Competition: Chipotle faces competition from other fast-casual restaurants and traditional fast-food chains.

* Economic downturns: Economic downturns can negatively impact consumer spending, leading to decreased demand for Chipotle’s products.

* Inflation and supply chain disruptions: Inflation and supply chain disruptions can increase costs and affect Chipotle’s profitability.

Industry Trends and Competition: Cmg Stock

Chipotle Mexican Grill operates in the highly competitive fast-casual restaurant industry, facing numerous rivals with similar offerings and business models. Understanding the industry dynamics and competitive landscape is crucial for assessing Chipotle’s future prospects.

Chipotle’s Performance Compared to Competitors

Chipotle’s performance is often benchmarked against other fast-casual chains like Panera Bread, Shake Shack, and Five Guys. While these competitors cater to different niches within the fast-casual segment, they share commonalities with Chipotle in terms of their focus on fresh ingredients, customizable menus, and a premium price point.

- Revenue Growth: Chipotle has consistently outpaced its peers in revenue growth, demonstrating its strong brand appeal and operational efficiency. In recent years, Chipotle’s revenue has grown at a faster rate than its competitors, indicating its ability to attract new customers and increase customer frequency.

- Same-Store Sales: Chipotle has consistently achieved positive same-store sales growth, reflecting its ability to maintain customer loyalty and attract new customers to existing locations. This metric is particularly important in the restaurant industry, as it reflects the performance of existing stores and the company’s ability to generate revenue without expanding its footprint.

- Profitability: Chipotle has generally exhibited higher profitability compared to its competitors, driven by its efficient operations, pricing strategy, and strong brand recognition. Its focus on fresh ingredients and a limited menu allows for streamlined operations and reduced food waste, contributing to its profitability.

Impact of Macroeconomic Factors, Cmg stock

The fast-casual restaurant industry is sensitive to macroeconomic factors, such as inflation and consumer spending. Inflationary pressures can lead to increased input costs, which restaurants may pass on to consumers in the form of higher prices. Consumer spending patterns are also crucial, as consumers may reduce their dining out frequency in response to economic uncertainty or rising prices.

- Inflation: Chipotle has been able to manage inflationary pressures by raising prices and implementing cost-saving measures. The company has also benefited from its strong brand loyalty, which allows it to pass on price increases to consumers without significantly impacting demand.

- Consumer Spending: Consumer spending on restaurant meals has been resilient in recent years, driven by factors such as the post-pandemic recovery and a shift towards convenience and value. However, economic uncertainty and inflation could impact consumer spending on discretionary items, such as restaurant meals.

Growth and Innovation Potential

The fast-casual restaurant industry is characterized by continuous innovation and growth opportunities. As consumers seek out new and exciting dining experiences, restaurants are constantly adapting their offerings and business models to stay ahead of the curve.

- Menu Innovation: Chipotle has been successful in expanding its menu while maintaining its core brand identity. The company has introduced new menu items, such as its cauliflower rice and pollo asado, to cater to evolving consumer preferences and dietary needs.

- Technology Integration: Restaurants are increasingly leveraging technology to enhance the customer experience and improve operational efficiency. Chipotle has invested heavily in digital ordering and payment systems, online ordering platforms, and mobile apps, which have streamlined the ordering process and increased customer convenience.

- Sustainability: Consumers are increasingly demanding sustainable practices from businesses. Chipotle has made strides in promoting sustainability by sourcing ingredients from local farmers, reducing food waste, and implementing environmentally friendly practices in its operations.

Investor Sentiment and Analyst Opinions

Investor sentiment and analyst opinions play a crucial role in shaping the market perception and future trajectory of a stock like CMG. Understanding the prevailing sentiment among investors and the forecasts of analysts can provide valuable insights into the potential risks and opportunities associated with investing in Chipotle Mexican Grill.

Analyst Consensus

Analysts generally hold a positive outlook on CMG stock, with a majority rating it as a “buy” or “strong buy.” This bullish sentiment is fueled by Chipotle’s consistent track record of revenue and earnings growth, strong brand recognition, and a loyal customer base. The consensus price target for CMG stock is currently [Insert current consensus price target].

Recent News and Events Influencing Investor Sentiment

Several recent news and events have impacted investor sentiment towards Chipotle. These include:

- Strong Q1 2023 Earnings Report: Chipotle’s first-quarter 2023 earnings report exceeded analysts’ expectations, with strong revenue growth and impressive same-store sales. This positive news boosted investor confidence and pushed the stock price higher.

- Increased Menu Prices: Chipotle has implemented several price increases in recent months to offset rising costs. While these price hikes may impact customer spending, they are expected to improve profitability in the long run. Investors are closely monitoring the impact of these price increases on sales volume and customer satisfaction.

- Labor Market Challenges: The tight labor market continues to be a challenge for Chipotle, as it faces pressure to attract and retain employees. This has resulted in higher labor costs and could potentially impact profitability in the future.

- Digital Ordering Growth: Chipotle continues to invest in its digital ordering and delivery capabilities, which have become increasingly popular among customers. This growth in digital ordering is expected to drive future sales and profitability.

Potential Risks and Opportunities

Several factors could impact the future performance of CMG stock:

- Economic Uncertainty: The current economic environment is marked by inflation, rising interest rates, and potential recessionary pressures. These factors could negatively impact consumer spending and hurt Chipotle’s sales growth.

- Competition: Chipotle faces stiff competition from other fast-casual restaurants, including Qdoba, Moe’s Southwest Grill, and Panera Bread. These competitors are constantly innovating and expanding their offerings, which could erode Chipotle’s market share.

- Food Safety Concerns: Chipotle has faced food safety challenges in the past, which have negatively impacted its reputation and sales. Any future food safety incidents could have a significant impact on investor sentiment and stock price.

- Operational Efficiency: Chipotle’s ability to maintain operational efficiency and control costs is crucial to its future success. Any disruptions to its supply chain or labor force could negatively impact profitability.

- Growth Opportunities: Chipotle has a strong track record of growth and expansion. The company continues to open new restaurants and expand its digital capabilities, which could drive future sales and profitability.

- Innovation: Chipotle is constantly innovating and introducing new menu items and services to attract customers. Its ability to stay ahead of the competition in terms of innovation will be key to its future success.